Tax Deduction Explanation

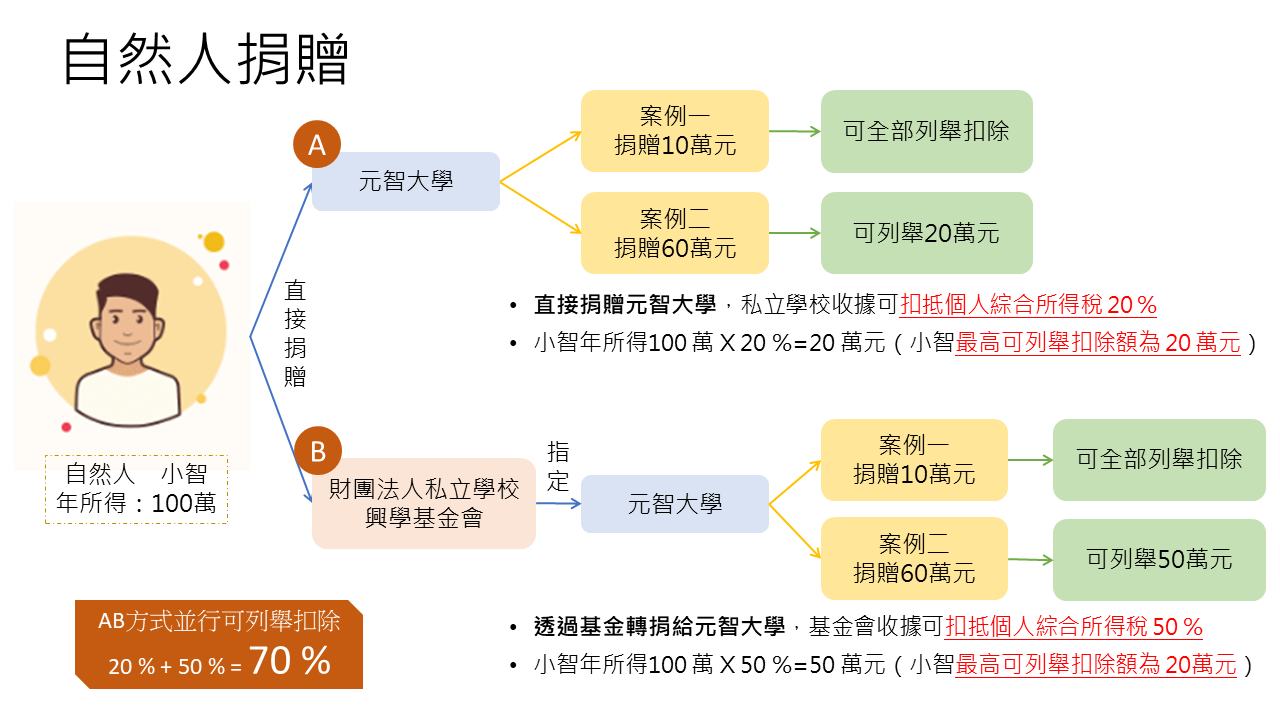

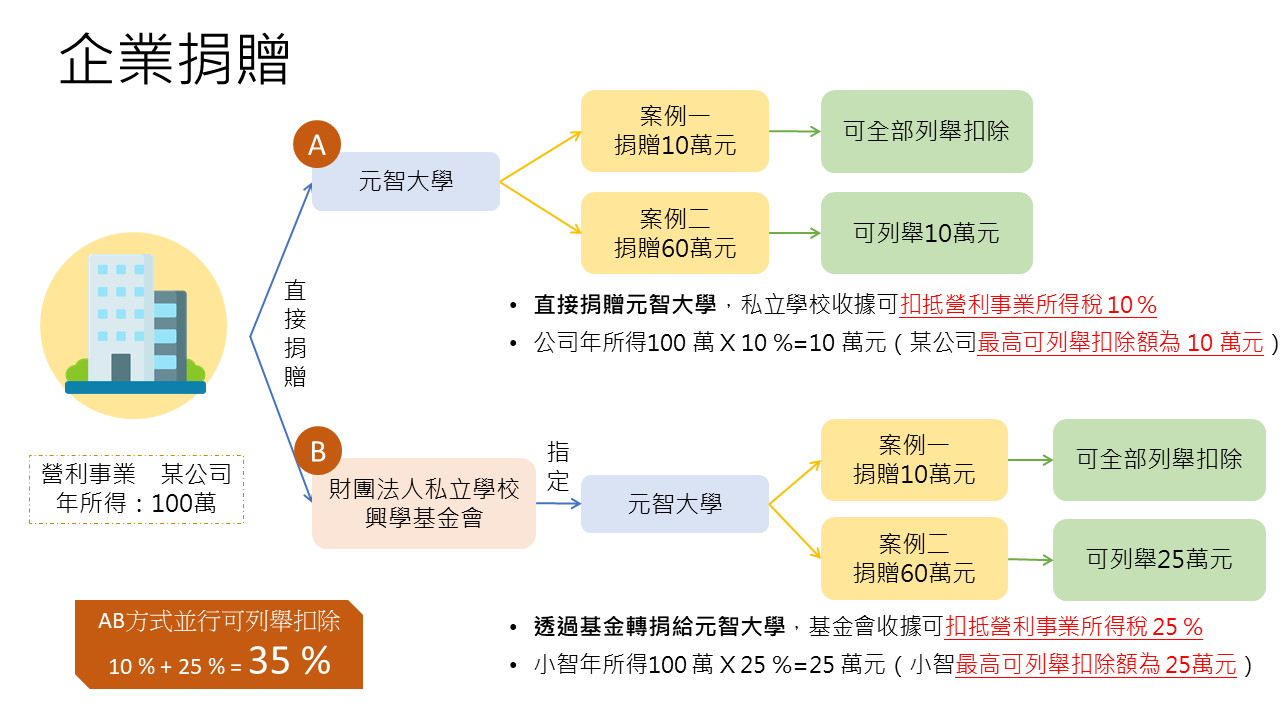

According to current tax laws in Taiwan, individuals who donate to educational institutions are eligible for tax deduction incentives. Donations to Yuan Ze University may qualify for a tax deduction of up to 70%!

Regulations

Income Tax Act, Article 17, Paragraph 1, Item 2, Sub-item 2

The total amount of donations made by a taxpayer, their spouse, and dependents to educational, cultural, public welfare, or charitable organizations may not exceed 20% of the total annual income.

Income Tax Act, Article 36, Paragraph 2

Corporate donations to educational, cultural, public welfare, or charitable organizations are limited to 10% of the corporate income.

Additionally, the Private School Promotion Foundation,co-founded by the Ministry of Education and three major private education organizations, allows donations to private schools through the foundation, with increased tax deduction limits:

1. Personal donation deduction limit increased to 50%.

2. Corporate donation deduction limit increased to 25%.

Reference Materials

Private School Act (Article 62)

Private School Donation Tax Deduction Comparison Table

Donation Method | Donor | Tax Deduction | |

|---|---|---|---|

Direct donation to school | Individual | 20% of total income | |

Corporation | 10% of corporate profit | ||

Through the Private School Promotion Foundation (designating Yuan Ze University) | Individual | 50% of total income | |

Corporation | 25% of corporate profit | ||

These two donation methods can be combined, allowing a maximum cumulative donation deduction of 70%.

For example, if an individual’s total income is 1 million, they can deduct up to 200,000 by donating directly to Yuan Ze University. Donating through the Private School Promotion Foundation can deduct up to 500,000. Combined, the total deductible amount reaches 700,000.

Electronic Processing for Donation Deduction Applications

To support the National Tax Administration's “Electronic Documentation for Income Tax Deductions,” which promotes energy conservation and convenience, donors who previously needed to submit paper receipts to the tax bureau can now authorize Yuan Ze University to submit donation records electronically to the tax authority after signing a consent form.

When you file your annual income tax returns online, the system automatically imports itemized data, so you don't need a receipt from the university. This way makes tax filing quick and convenient.

Additional Reference Materials

Consent Form for Providing Donation Information to the National Tax Administration

Donation Case Studies: Individual and Corporate Donations

Additional Resources:

Tax exemption for inheritance estate donations to universities proposed by the principal

Donation deduction amounts vary based on the recipient or donation method

Proposal for 100% tax exemption for donations through private school foundations

You can designate your donations to Yuan Ze University for specific purposes, such as scholarships, emergency assistance, or library resources. For further information on tax-saving options, please contact Ms. You in the Public Affairs Office at Yuan Ze University.

捐資興學聯絡方式

業務聯絡人:游小姐

聯絡電話:03-4638800分機2317

E-mail:proffice@saturn.yzu.edu.tw

傳真:03-4637488

地址:32003桃園市中壢區遠東路135號 公共事務室暨校友服務中心

En

En  繁

繁